The commodities rout that knocked off $99 billion of market value last week is driving out speculators and leading Goldman Sachs Group Inc., which forecast the plunge, to predict a possible recovery.[...]

Fed Has Power To Pop Commodity Bubble

I don't know about you, but I'm fed up with being held hostage economically by Wall Street speculators who are driving food and fuel prices up through the roof. The recent plunge in commodities prices confirms what everyone knew all the time: inflation is being driven by commodities speculators who are profiting from everyone else's collective misery. If margin rule changes for a minor commodity.[...]

Goldman Sees Commodity Recovery as Slump Wipes Out $99 Billion

The commodities rout that knocked off $99 billion of market value last week is driving out speculators and leading Goldman Sachs Group Inc., which forecast the plunge, to predict a possible recovery.[...]

Commodity ETFs: New Volatility

Commodity ETFs are among the most popular and successful funds in the market today. They are best used strategically.[...]

The Commodity Bull Market Isn't Over

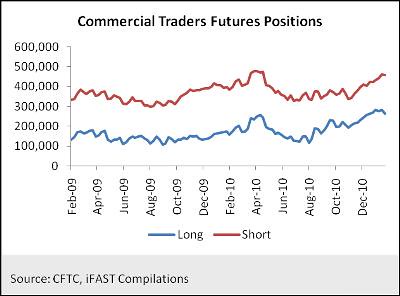

Commodities have taken a hit recently, but the overall trend remains positive. Consider this multi-w[...]

Former regulator eyes margin to tamp speculation

A former top Commodity Futures Trading Commission official is calling for further margin requirements on a wide-variety of commodity trades in the wake of Thursday's plunge in commodities.[...]

Tanzania Plans to Open Commodity Exchange Later This Year, Daily News Says

The Tanzania Commodity Exchange will have a trading floor, warehouses and price tickers, the Dar es Salaam-based newspaper said. It will initially trade coffee, the East African nation's main agricultural export, as well as cashew nuts, the Daily News said.[...]

Commodity trading: Plunge in US hits Asian stocks

Commodity trading reversals in US cause Japan and Korean markets to fall. Asian mining, energy companies drop with negative cast to commodity trading.[...]

More Volatile Commodity Prices Make Goods More Costly

For reasons not well understood, commodities have become more volatile, increasing the costs of the futures and options that protect companies against such changes.[...]

No comments:

Post a Comment